版权说明:本文档由用户提供并上传,收益归属内容提供方,若内容存在侵权,请进行举报或认领

文档简介

1、题型:(范围28章)1填空:5题10分2选择:10题20分3判断:10题10分4简答:2题10分5计算:4题40分6论述:1题10分第二章 Payments among Nations 国际收支1.Accounting principles 记账原则A credit item (+)positive items: a country must be paid; payment by a foreigner into the country.包括:Exports of goodsPurchases by foreigners in this countryForeigners investing

2、 in the countrys bondsA debit item (-)negative items: a country must pay; payment by the country to a foreigner.包括:Imports of goodsPurchases by firms in this country from foreign countriesPurchases by investors in this country from foreigners2Balance of Payments Statement国际收支平衡u Current account(经常账户

3、):简CA(商品、服务的进出口、对外国金融资产的支付和收益、单方面转移)u Financial account(金融账户):简FA (直接投资、国际证券投资)u Official international reserves(官方国际储备):简OR(黄金、外汇资产、在国际货币基金的特别提款权)u 三个国际收支部分,根据Each transaction has two item, one positive and one negative, of equal value. double-entry bookkeeping复式记账法有:positive items + negative items

4、 = 0positive balance: surplusnegative balance: deficit(1) Current account balance经常账户差额经常账户差额(CA) = 商品贸易差额 + 劳务差额加上收入净额 + 无偿转移收支净额之和。盈余():一国在与外国交易中增加了资产或减少了负债。赤字():一国在与外国交易中减少了资产或增加了负债。CA = If (Net foreign investment (If):净国外投资)CA = S Id (National saving (S):国际储备 ,domestic investment (Id):国内投资.) S =

5、 Id + If (国际储备=国内投资+净国外投资)Y = C + Id + G +(X M) (商品和劳务的生产= 消费+投资政府支出贸易差额)E = C + Id + G (对商品和劳务总支出=消费+投资政府支出)据Y = E +(X M), CA = (X M) 可以推导出CA = Y ESurplus盈余Deficit赤字Positive net foreign investment lender) 贷款者Net foreign borrower借款者Saving more than investing domestically 储蓄超过国内投资Domestic savings les

6、s than domestic investment储蓄低于国内投资Producing more than spending on goods and services 生产超过支出Spending more than producing生产少于支出If CA is in deficit, then what could we do?(若CA是赤字,我们应该怎么做?)Increase Y, or decrease E.(增加商品和劳务的生产,或减少对商品和劳务的总支出)(2)Official settlements balance官方结算差额OR Current account balance

7、 + Private capital balance 即B = CA + KA 因为所有项目最终差额必须为0,所以官方结算差额的不平衡必须用官方储备资产(OR)来弥补,因此,B + OR = 0意义: 如B>0,则外汇贮备增加。 如B<0,则外汇贮备减少。l 课后作业8. you are given the following information about a countrys international transactions during a year:Merchandise exports 商品出口 $330Merchandise imports 商品进口 198Se

8、rvice exports 劳务出口 196Service imports 劳务进口 204Imcome flows,net流量净额 3Unilateral transfers,net 单方面转移金额 -8Increase in the countrys holding of foreign assets,net 202(excluding official reserve assets)增加在该国的净外国资产Increase in foreign holding of the countrys assets,net 102(excluding official reserve assets)

9、增加在该国的本国资产 Statistical discrepancy, net净统计误差 4A. Caculate the values of the countrys goods and services balance,current account balance经常账户余额,and official settlements balance官方储备资产余额.Merchandise trade balance: $330 - 198 = $132Goods and services balance: $330 - 198 + 196 - 204 = $124Current account

10、balance: $330 - 198 + 196 - 204 + 3 - 8 = $119Official settlements balance: $330 - 198 + 196 - 204 + 3 - 8 + 102 - 202 + 4 = $23B.What is the value of the change in official reserve assets(net)官方储备资产?Is the country increasing or decreasing its net holding of official reserve assets?Change in officia

11、l reserve assets (net) = - official settlements balance = -$23.The country is increasing its net holdings of official reserve assets.第三章The Foreign Exchange Market 外汇市场Exchange rate汇率:an exchange rate is the price of one nations money in terms of another nations money.Floating exchange rate and fixe

12、d exchange rate 浮动汇率和固定汇率Arbitrage within the spot exchange market现汇市场的套汇Spot exchange rate 即期汇率eForward exchange rate 远期汇率fRetail part of the market 外汇零售市场(银行与个人、公司等一般客户之间的外汇交易市场。)Interbank part of the market 外汇批发市场(银行同业之间的外汇买卖及其场所。)vehicle currency媒介货币 depreciation贬值demand deposits活期存款 appreciatio

13、n 升值Quotations 报价 devaluation法定贬值Par value平价 revaluation 法定升值Arbitrage套利 Cross-rate交叉汇率Direct arbitrage直接套利Triangular arbitrage 三角套汇-arbitrage through three rates1.Demand and supply for foreign exchange (外汇的需求与供给)(1)U.S exports of goods and services will create a supply of foreign currency and a dem

14、and for U.S. dollars. 美国的商品和服务的出口将造成大量的外国货币供应量和对美元的需求。(2)U.S imports of goods and services will create a demand for foreign currency and a supply of U.S. dollars.美国的商品和服务进口将创建一个为外国货币和美元的供给需求(3)U.S capital outflows will create a demand for foreign currency. 美国资本外流将创建一个为外国货币的需求。(4)U.S capital inflows

15、will create a supply of foreign currency. 美国资本流入将创造大量的外国货币供应量。u 一国商品和劳务的出口形成了外币的供给,进口形成对外币的需求。u 对国外金融资产的购买形成外币的需求,外国对本国金融资产的购买形成了外币的供给。l 课后作业1. What are the major types of transactions or activities the result in supply of foreign currency in the spot foreign exchange market?在即期外汇市场造成外币供应的主要交易或活动有哪些

16、?Exports of merchandise and services 劳务和商品的出口result in supply of foreign currency in the foreign exchange market. Domestic sellers often want to be paid using domestic currency, while the foreign buyers want to pay in their currency. In the process of paying for these exports, foreign currency is ex

17、changed for domestic currency, creating supply of foreign currency. International capital inflows 国际资本流入result in a supply of foreign currency in the foreign exchange market. In making investments in domestic financial assets, foreign investors often start with foreign currency and must exchange it

18、for domestic currency before they can buy the domestic assets. The exchange creates a supply of foreign currency. Sales of foreign financial assets that the country's residents had previously acquired, and borrowing from foreigners by this country's residents are other forms of capital inflo

19、w that can create supply of foreign currency8.You have access to the following three spot exchange rates即期汇率:$ 0.01 / yen$ 0.20 / krone25 yen / kroneA. how would engage in arbitrage(套利) to profit from these three rates? What is the profit for each dollar used initially?The arbitrage will be: Use dol

20、lars to buy kroner at $0.20/krone, use these kroner to buy yen at 25 yen/krone, and use the yen to buy dollars at $0.01/yen.For each dollar that you sell initially, you can obtain 5 kroner, these 5 kroner can obtain 125 yen, and the 125 yen can obtain $1.25. The arbitrage profit for each dollar is t

21、herefore 25 cents.第四章Forward Exchange and International Financial Investment 远期交易与国际金融投资forward foreign exchange contracts 远期外汇合同 Hedging and speculating by forward foreign exchange远期外汇的套期保值和投机International Financial Investment国际金融投资 Covered International Investment 抛补性国际投资Uncovered International In

22、vestment 非抛补性国际投资Forward foreign exchange contract远期外汇合同:是指在约定未来某一日期以一定的外汇汇率(远期汇率)买进或卖出一定金额外币的合同。Hedging using forward foreign exchange 远期外汇合同用于套期保值:套期保值包括获取外币资产来冲销已有的外币净债务,或者获取外币债务来冲销已有的外币净资产。 long position(多头):有的外币净资产的数量即多头。short position(空头):外币净负债(即借入待还)的数量即空头。Expected uncovered interest differen

23、tial (期非抛补利息差)Hedging套期保值 dollar-denominated (美元面值的)speculate(投机) inheriting (继承)Speculation投机 Covered interest arbitrage(补套利)receivable (应收账款). disbursed (支付)portfolio(投资组合) diversification (多样化)1.Speculating using forward foreign exchange 远期外汇合同用于投机4月时预计英镑价格从 $1.98/ 下降至$1.70/ (7月)签订3个月后卖出1百万英镑的远期合

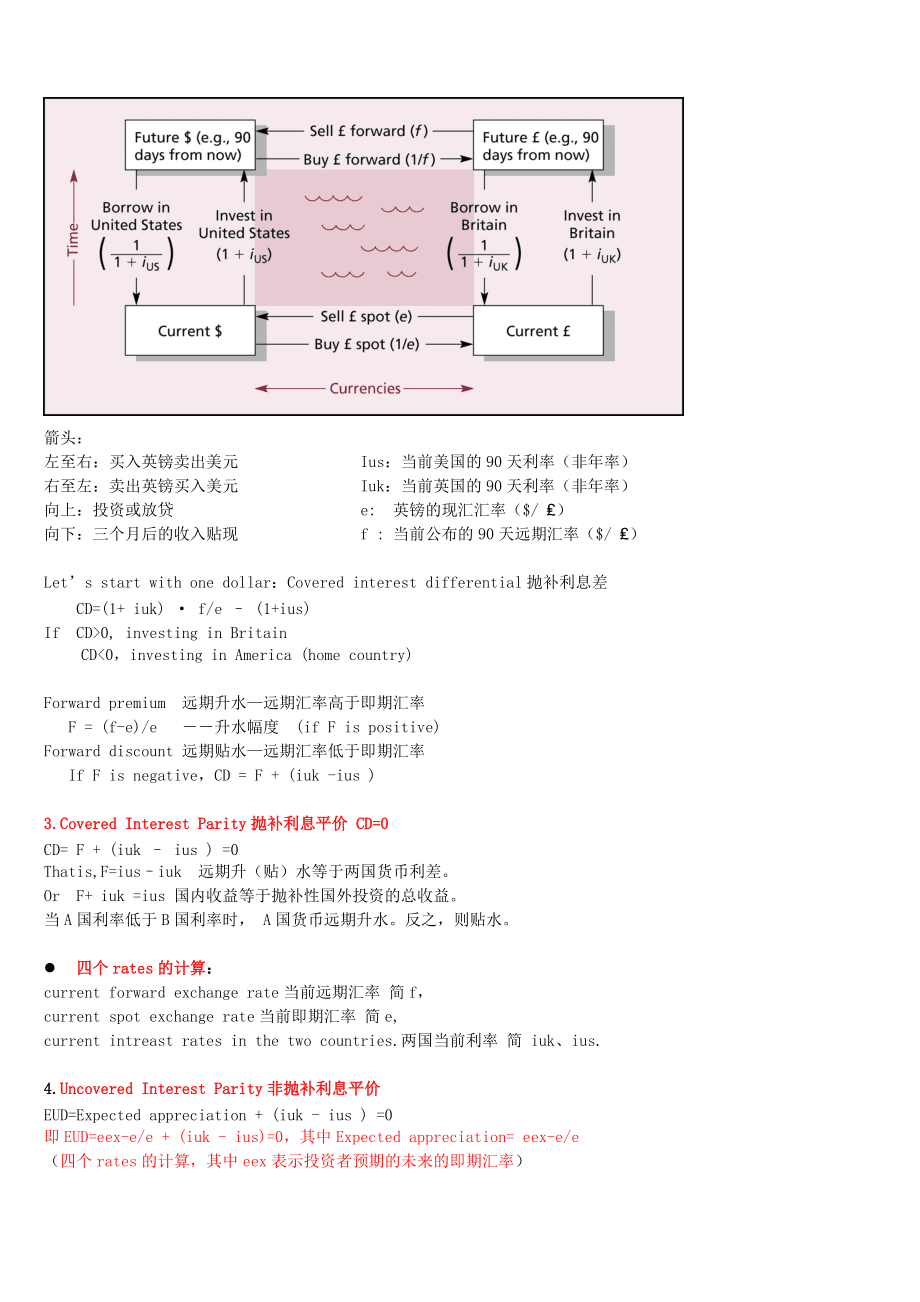

24、同,90天远期汇率$1.9668 / )3个月后,英镑价格如期下跌至$1.70/ 按现汇买入1百万英镑,支付$1,700,000结清合同,获利 $266,800Principle of "buy low, sell high"Your speculation may turn out differently :4月时预计英镑价格从 $1.98/ 下降至$1.70/ (7月)签订3个月后卖出1百万英镑的远期合同,90天远期汇率$1.9668 / .3个月后,英镑价格上升至$2.20/ 按现汇买入1百万英镑, 支付$2,200,000结清合同,亏损 $233,2002.Cove

25、red International Investment 抛补性国际投资箭头:左至右:买入英镑卖出美元 Ius:当前美国的90天利率(非年率)右至左:卖出英镑买入美元 Iuk:当前英国的90天利率(非年率)向上:投资或放贷 e: 英镑的现汇汇率($/ )向下:三个月后的收入贴现 f : 当前公布的90天远期汇率($/ )Lets start with one dollar:Covered interest differential抛补利息差CD=(1+ iuk) · f/e (1+ius) If CD>0, investing in BritainCD<0,investi

26、ng in America (home country)Forward premium 远期升水远期汇率高于即期汇率F = (f-e)/e 升水幅度 (if F is positive)Forward discount 远期贴水远期汇率低于即期汇率If F is negative,CD = F + (iuk -ius ) 3.Covered Interest Parity抛补利息平价 CD=0CD= F + (iuk ius ) =0Thatis,F=iusiuk 远期升(贴)水等于两国货币利差。Or F+ iuk =ius 国内收益等于抛补性国外投资的总收益。当A国利率低于B国利率时, A国

27、货币远期升水。反之,则贴水。l 四个rates的计算:current forward exchange rate当前远期汇率 简f,current spot exchange rate当前即期汇率 简e,current intreast rates in the two countries.两国当前利率 简 iuk、ius.4.Uncovered Interest Parity非抛补利息平价EUD=Expected appreciation + (iuk - ius ) =0 即EUD=eex-e/e + (iuk - ius)=0,其中Expected appreciation= eex-e

28、/e(四个rates的计算,其中eex表示投资者预期的未来的即期汇率)That is, expected appreciation of the pound =ius iuk 预期英镑升(贬)值等于两国货币利差Or expected appreciation + iuk =ius 国内收益等于非抛补性国外投资的总收益。l EUD=Expected depreciation + (iuk -ius ) < 0The U.S. investor should invest dollar-denominated bonds.EUD=Expected appreciation + (ius -

29、iuk) > 0The U.K. investor should invest dollar-denominated bondsl 课后练习4The current spot exchange rate当前即期汇率 is $0.010/yen.The current 60-day forward exchange rate 当前远期汇率is $0.009/yen.How would the U.S firms and people described in question 3 each use a forward foreign exchange contract远期外汇合同 to h

30、edge 规避their risk exposure风险 ?what are the amounts in each forward contract ?a.The U.S. firm has an asset position in yenit has a long position in yen. To hedge its exposure to exchange rate risk, the firm should enter into a forward exchange contract now in which the firm commits to sell yen and re

31、ceive dollars at the current forward rate. The contract amounts are to sell 1 million yen and receive $9,000, both in 60 days.b.The student has an asset position in yena long position in yen. To hedge the exposure to exchange rate risk, the student should enter into a forward exchange contract now i

32、n which the student commits to sell yen and receive dollars at the current forward rate. The contract amounts are to sell 10 million yen and receive $90,000, both in 60 days.c.The U.S. firm has an liability position in yena short position in yen. To hedge its exposure to exchange rate risk, the firm

33、 should enter into a forward exchange contract now in which the firm commits to sell dollars and receive yen at the current forward rate. The contract amounts are to sell $900,000 and receive 100 million yen, both in 60 days.5.The current exchange rate即期汇率 is $1.20/euro.The current 90-day forward ex

34、change rate当前远期汇率 is $1.18/euro.You expect the spot rate to be $1.22/euro in 90 days .How would you speculate投机 using a forward contract?If many speculate in this way ,what a pressure is placed on the value of the current forward exchange rate?Relative to your expected spot value of the euro in 90 d

35、ays ($1.22/euro), the current forward rate of the euro ($1.18/euro) is lowthe forward value of the euro is relatively low. Using the principle of "buy low, sell high," you can speculate by entering into a forward contract now to buy euros at $1.18/euro. If you are correct in your expectati

36、on, then in 90 days you will be able to immediately resell those euros for $1.22/euro, pocketing a profit of $0.04 for each euro that you bought forward.If many people speculate in this way, then massive purchases now of euros forward (increasing the demand for euros forward) will tend to drive up t

37、he forward value of the euro, toward a current forward rate of $1.22/euro.8.The following rates are available in the markets:Current spot exchange rate即期汇率: $0.500/FrCurrent 30-day forward exchange rate当前30天远期汇率: $0.505/SFrAnnualized interest rate on 30-day dollar-denominated bonds 30天美元计价券的年利率 : 12

38、%(1.0%for 30 days)Annualized interest rate on 30-day swiss franc -denominated bonds 30天瑞郎计价券的年利率 : 6%(0.5%for 30 days)A. Is the swiss franc at a forward premium or discount远期溢价或折价?The Swiss franc is at a forward premium. Its current forward value ($0.505/SFr) is greater than its current spot value (

39、$0.500/SFr).B. Should a U.S-based investor make a covered investment in swiss franc-denominated 30-day bonds ,rather than investing in 30-day dollar-denominated bonds?explain.CD=F+ iuk -ius =( 0.505-0.5)/0.5+(0.005-0.01)=0.005, there is a covered interest differential of 0.5% for 30 days (6 percent

40、at an annual rate). The U.S. investor can make a higher return, covered against exchange rate risk, by investing in SFr-denominated bonds.第五章What Determines Exchange Rates? 汇率是由什么决定的?focuses on short-run movements in exchange rates. 短期内汇率变动focuses on long-term trends. 长期内汇率变动shows one way in which t

41、he short term flows into the medium term and then into the long term.短期汇率变动对中长期的影响。Asset market approach to exchange rates 资产市场说portfolio repositioning (投资组合重置)Ø The long run: the monetary approach长期:货币理论The quantity theory (货币数量理论)货币数量公式:Ms=k×P×Y (1)Mfs=kf×Pf×Yf (2)Ms: Mone

42、y supply 货币供给k: proportional relationships between money holdings and the nominal value of GDP货币持有量和GDP的名义价值之比(代表消费者的行为)P: price level 价格水平Y: real domestic products 实际国内产出1.Three types of variability for exchange rates(三种变异类型的汇率)Long-term trends.Medium-term (over periods of several years) trends.Sho

43、rt-term (month to month) variability.2.短期汇率的决定因素变量的变化国际金融资产重组方向对当前现汇汇率的影响 (e =本币/外币)国内利率 (i) 增加转向本币资产e 减少 (本币升值)减少转向外币资产e 增加 (本币贬值)国外利率 (if) 增加转向外币资产e 增加 (本币贬值)减少转向本币资产e 减少 (本币升值)预期远期现汇汇率(eex) 增加转向外币资产e 增加 (本币贬值)减少转向本币资产e 减少 (本币升值)分析基于三个变量中一个发生变化时,其他两个不变,对现汇汇率的影响。n I

44、f domestic i increases, while if and eex投资者预期的未来的即期汇率 remained constant,the return comparison shifts in favor of investments in domestic bonds.Why?This increase demand for domestic currency increases the current spot exchange rate value of domestic currency ,so e当前即期汇率 decreases.n If foreign i incre

45、ases, while i and eex remained constant, the return comparison shifts in favor of investments in foreign bonds.This increase demand for foreign currency increases the current spot exchange rate e (the domestic currency depreciates)3.The Long Run: Purchasing Power Parity长期:购买力平价说 (PPP)Three versions:

46、² The law of one price 一价定律:商品的国内价格等于国外价格乘以现汇汇率。P = e × Pf该定律对交易大宗商品来说是正确的。如,黄金,其他金属,原油和农产品。“一价定律”在现实中已失去意义。² Absolute purchasing power parity 绝对购买力平价说:汇率取决于以不同货币衡量的多种可贸易商品价格水平之比。 P = Pf×e -or- e = P/Pf绝对购买力平价不成立。² Relative purchasing power parity 相对购买力平价说:Rate of appreciati

47、on of the foreign currency=f国外货币的升贬值率 = 国内通胀率国外通胀率若 > 0,本币贬值< 0,本币升值4.The effect of money supplies on an exchange rate货币供给对汇率的影响Example: (英国为外国,美国为本国)英国减少10的货币供给英镑减少,变得更值钱从紧货币政策,银行缩减信贷造成借贷困难,减少了总需求,产出,就业。价格水平下降10根据相对购买力平价说, 英镑汇率上升10The effect of real incomes on an exchange rate 实际收入对汇率的影响Examp

48、le: (英国为外国,美国为本国)英国生产力上升,实际收入增加了10增加了人们对英镑的需求但假定英国货币存量没有增加,则物价会下降10根据相对购买力平价说,英镑汇率上升10l 课后作业2.The following rates currently exist:Spot exchange rate即期汇率 :$1.000/euroAnnual interest rate on 180-day euro denominated bonds 180欧元计价券的年利率 :3%Annual interest rate on 180-day U.S dollar denominated bonds 180

49、天美元计价券的年利率:4%Investors currently expect the spot exchange rate to be about $1.005/euro in180 daysA. Show that uncovered interest parity抛补利率平价 holds(appromixmately)at these rates.The euro is expected to appreciate at an annual rate of approximately (1.005 - 1.000)/1.000)×(360/180) = 1%. The expe

50、cted uncovered interest differential is approximately 1% + 3% - 4% = 0, so uncovered interest parity holds (approximately)B. What is likely to be the effect on the spot exchange rate即期汇率 if the interest rate on 180-day dollar-denominated bonds 180天美元计价券的利率declines to 3 percent?If the euro interest r

51、ate and the expected future spot rate are unchanged ,and if uncovered interest parity 抛补利息平价is reestablished重建 ,what will the new current spot exchange rate be ? Has the dollar appreciated or depreciated升值或贬值?If the interest rate on 180-day dollar-denominated bonds declines to 3%, the expected uncov

52、ered interest differential shifts in favor of investing in euro-denominated bonds. The increased demand for euros in the spot exchange market tends to appreciate the euro. Since ieu=3%, eex =$1.005/euro, EUD=0, e? (1.005-e)/e + (3% - 3%)= 0 e=$1.005/euroWith e increasing, U.S. dollar depreciates4.Yo

53、u observe the following current rates:Spot exchange rate:$0.01/yenAnnual interest rate on 90-day U.S -dollardenominated bonds :5%Annual interest rate on 90-day yendenominated bonds :4%A. If uncovered interest parity holds, what spot exchange rate do investors expect to exist in 90 days?For uncovered

54、 interest parity holds, (eex-0.01)/0.01 + 4% - 4%=0 eex= $0.01/yen.B. A close U.S presidential election 美国总统选举has just been decided.the candidate whom international investors view as the stronger and more probusiness person won.Because if this ,investors expect the exchange rate to be $0.0095/yen in

55、 90 days.what will happen in the foreign exchange market?If investors expect that the exchange rate will be $0.0095/yen, then they expect the yen to depreciate from its initial spot value during the next 90 days. Given the other rates, investors tend to shift their investments toward dollar-denominated investments. The extra supply of yen (and demand for dollars) in the spot exchange market results in a decrease in the current spot value of the yen (the dollar appreciates). Thus, the yen will depreciate (the dollar to appreciate) immediately in the current spot

温馨提示

- 1. 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

- 2. 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

- 3. 本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

- 4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

- 5. 人人文库网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

- 6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

- 7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。

最新文档

- 出售转让网店合同样本

- 2024年份3月线上声乐教师虚拟演唱会分成补充协议

- 共享产权房合同样本

- 2025建屋合同(标准版)

- 农村浴室出售合同标准文本

- 农村地基打桩合同样本

- 打造智能社区的未来愿景计划

- 伐木工具租赁合同样本

- 2025合同的订立程序包括哪些步骤

- 农村收购土牛合同样本

- 2025年吉林司法警官职业学院单招职业倾向性考试题库含答案

- 2025年开封大学单招职业适应性考试题库带答案

- 国际合作与中外合拍片的发展现状

- 统编版语文二年级下册第三单元 复习课件

- 糖尿病酮症酸中毒患者的护理查房

- 网络周期窃取演变-洞察分析

- 《excel学习讲义》课件

- 医疗质量与安全管理和持续改进评价考核标准

- 《老挝英文介绍》课件

- 2025年湖南常德烟机公司招聘笔试参考题库含答案解析

- 2025年中国联通招聘笔试参考题库含答案解析

评论

0/150

提交评论