版权说明:本文档由用户提供并上传,收益归属内容提供方,若内容存在侵权,请进行举报或认领

文档简介

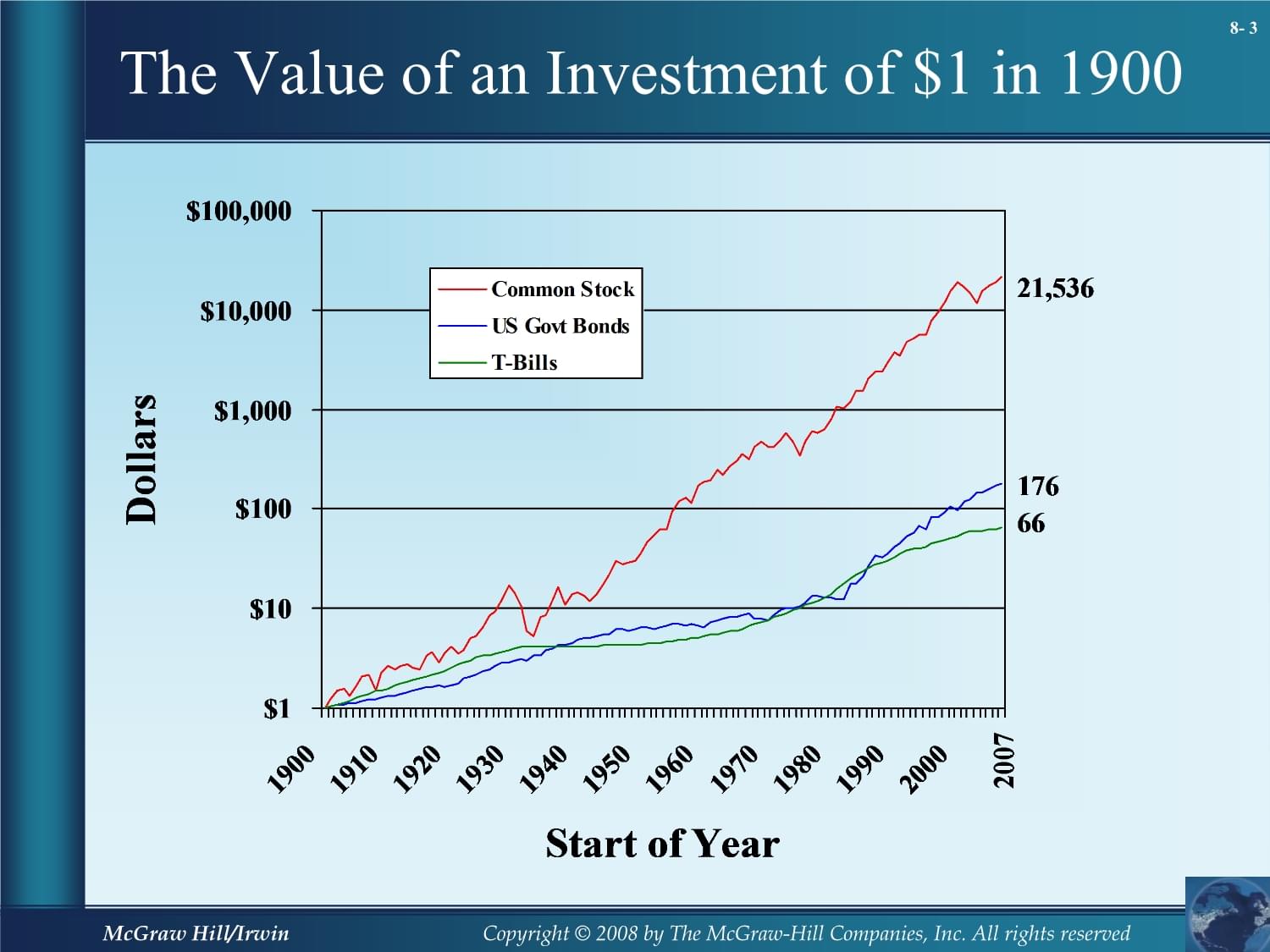

Chapter8PrinciplesofCorporateFinanceNinthEditionIntroductiontoRisk,Return,andTheOpportunityCostofCapitalSlidesbyMatthewWillCopyright©2021byTheMcGraw-HillCompanies,Inc.AllrightsreservedMcGrawHill/IrwinTopicsCoveredOveraCenturyofCapitalMarketHistoryMeasuringPortfolioRiskCalculatingPortfolioRiskHowIndividualSecuritiesAffectPortfolioRiskDiversification&ValueAdditivityTheValueofanInvestmentof$1in1900TheValueofanInvestmentof$1in1900RealReturnsAverageMarketRiskPremia(bycountry)Riskpremium,%CountryDividendYield(1900-2006)RatesofReturn1900-2006Source:IbbotsonAssociatesYearPercentageReturnStockMarketIndexReturnsMeasuringRiskReturn%#ofYearsHistogramofAnnualStockMarketReturns(1900-2006)EquityMarketRisk(bycountry)StandardDeviationofAnnualReturns,%AverageRisk(1900-2006)DowJonesRiskAnnualizedStandardDeviationoftheDJIAoverthepreceding52weeks(1900–2006)MeasuringRiskVariance-Averagevalueofsquareddeviationsfrommean.Ameasureofvolatility.StandardDeviation-Averagevalueofsquareddeviationsfrommean.Ameasureofvolatility.MeasuringRiskCoinTossGame-calculatingvarianceandstandarddeviationMeasuringRiskDiversification-Strategydesignedtoreduceriskbyspreadingtheportfolioacrossmanyinvestments.UniqueRisk-Riskfactorsaffectingonlythatfirm.Alsocalled“diversifiablerisk.〞MarketRisk-Economy-widesourcesofriskthataffecttheoverallstockmarket.Alsocalled“systematicrisk.〞MeasuringRiskMeasuringRiskMeasuringRiskPortfolioRiskThevarianceofatwostockportfolioisthesumofthesefourboxesPortfolioRiskExample

Supposeyouinvest60%ofyourportfolioinWal-Martand40%inIBM.TheexpecteddollarreturnonyourWal-Martstockis10%andonIBMis15%.Theexpectedreturnonyourportfoliois:PortfolioRiskExample

Supposeyouinvest60%ofyourportfolioinWal-Martand40%inIBM.TheexpecteddollarreturnonyourWal-Martstockis10%andonIBMis15%.Thestandarddeviationoftheirannualizeddailyreturnsare19.8%and29.7%,respectively.Assumeacorrelationcoefficientof1.0andcalculatetheportfoliovariance.PortfolioRiskExample

Supposeyouinvest60%ofyourportfolioinWal-Martand40%inIBM.TheexpecteddollarreturnonyourWal-Martstockis10%andonIBMis15%.Thestandarddeviationoftheirannualizeddailyreturnsare19.8%and29.7%,respectively.Assumeacorrelationcoefficientof1.0andcalculatetheportfoliovariance.PortfolioRiskExample

Supposeyouinvest60%ofyourportfolioinExxonMobiland40%inCocaCola.TheexpecteddollarreturnonyourExxonMobilstockis10%andonCocaColais15%.Theexpectedreturnonyourportfoliois:PortfolioRiskExample

Supposeyouinvest60%ofyourportfolioinExxonMobiland40%inCocaCola.TheexpecteddollarreturnonyourExxonMobilstockis10%andonCocaColais15%.Thestandarddeviationoftheirannualizeddailyreturnsare18.2%and27.3%,respectively.Assumeacorrelationcoefficientof1.0andcalculatetheportfoliovariance.PortfolioRiskExample

Supposeyouinvest60%ofyourportfolioinExxonMobiland40%inCocaCola.TheexpecteddollarreturnonyourExxonMobilstockis10%andonCocaColais15%.Thestandarddeviationoftheirannualizeddailyreturnsare18.2%and27.3%,respectively.Assumeacorrelationcoefficientof1.0andcalculatetheportfoliovariance.PortfolioRiskPortfolioRiskExampleCorrelationCoefficient=.4Stocks s %ofPortfolio AvgReturnABCCorp 28 60% 15%BigCorp 42 40% 21%StandardDeviation=weightedavg=33.6StandardDeviation=Portfolio=28.1

RealStandardDeviation: =(282)(.62)+(422)(.42)+2(.4)(.6)(28)(42)(.4) =28.1CORRECTReturn:r=(15%)(.60)+(21%)(.4)=17.4%PortfolioRiskExampleCorrelationCoefficient=.4Stocks s %ofPortfolio AvgReturnABCCorp 28 60% 15%BigCorp 42 40% 21%StandardDeviation=weightedavg=33.6StandardDeviation=Portfolio=28.1

Return=weightedavg=Portfolio=17.4%Let’sAddstockNewCorptotheportfolioPortfolioRiskExampleCorrelationCoefficient=.3Stocks s %ofPortfolio AvgReturnPortfolio 28.1 50% 17.4%NewCorp 30 50% 19%NEWStandardDeviation=weightedavg=31.80

NEWStandardDeviation=Portfolio=23.43

NEWReturn=weightedavg=Portfolio=18.20%NOTE:Higherreturn&LowerriskHowdidwedothat? DIVERSIFICATIONPortfolioRiskTheshadedboxescontainvarianceterms;theremaindercontaincovarianceterms.123456N123456NSTOCKSTOCKTocalculateportfoliovarianceadduptheboxesBetaandUniqueRiskbetaExpectedreturnExpectedmarketreturn10%10%-+10%+10%stockCopyright1996byTheMcGraw-HillCompanies,Inc-10%1.Totalrisk=diversifiablerisk+marketrisk2.Marketriskismeasuredbybeta,thesensitivitytomarketchangesBetaandUniqueRiskMarketPortfolio-Portfolioofallassetsintheeconomy.Inpracticeabroadstockmarketindex,suchastheS&PComposite,isusedtorepresentthemarket.

温馨提示

- 1. 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

- 2. 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

- 3. 本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

- 4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

- 5. 人人文库网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

- 6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

- 7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。

最新文档

- 2025年便利店智能化门店运营与顾客忠诚度提升报告

- 2025年便利店新零售背景下供应链金融模式创新报告

- 北京化工大学《汉中国风艺术设计》2023-2024学年第二学期期末试卷

- 《电子商务实务》课件任务三 零基础如何成为商品照片美化处理高手

- 幼儿园大班科学探索《给脚趾头起名字》课件

- 北华大学《民族舞》2023-2024学年第二学期期末试卷

- 北方工业大学《临床基础检验学技术实验》2023-2024学年第二学期期末试卷

- 保定学院《风景园林综合实践》2023-2024学年第二学期期末试卷

- 2025至2031年中国视频通信模块行业投资前景及策略咨询研究报告

- 2025至2031年中国花样轮调节齿轮行业投资前景及策略咨询研究报告

- 拖拉机驾驶员培训(课件)

- 媒介发展史概论

- 儿童慢性病管理的挑战与解决方案

- 两办意见八硬措施煤矿安全生产条例宣贯学习课件

- 2024年6月福建省普通高中学生学业基础会考生物试题

- TCI 263-2024 水上装配式钢结构栈桥(平台)施工技术规程

- 第8课《求救信号》课件

- 某公路工程有限公司专项应急预案及某公路项目部安全生产应急预案

- 甲状腺结节射频消融术后护理

- 湖北省华中师大一附中2024届数学高二第二学期期末质量检测试题含解析

- 种植牙沙龙策划方案

评论

0/150

提交评论