版权说明:本文档由用户提供并上传,收益归属内容提供方,若内容存在侵权,请进行举报或认领

文档简介

1、.:.;Chapter 1: Financial Time Series and Their CharacteristicsData used in the text:(1) Daily log returns of IBM (62/7/3 to97/12): HYPERLINK /ruey.tsay/teaching/fts/d-ibmln.dat d-ibmln.dat(2) Dailysimple returns of value-weighted and equal-weighted indexes: HYPERLINK faculty.

2、/ruey.tsay/teaching/fts/d-vwew.dat d-vwew.dat(3) Dailysimple returns of Intel stock: HYPERLINK /ruey.tsay/teaching/fts/d-intc.dat d-intc.dat(4) Daily simple returns of 3M stock: HYPERLINK /ruey.tsay/teaching/fts/d-mmm.dat d-mmm.dat(5) D

3、aily simple returns of Microsoft stock: HYPERLINK /ruey.tsay/teaching/fts/d-msft.dat d-msft.dat(6) Daily simple returns of Citi-group stock: HYPERLINK /ruey.tsay/teaching/fts/d-citi.dat d-citi.dat(7) Monthly bond returns (30 yrs, 20 yrs, ., 1 yr): HYPE

4、RLINK /ruey.tsay/teaching/fts/m-bnd.dat m-bnd.dat(8) Monthly Treasury rates (10 yrs, 5 yrs, ., 1 yr): HYPERLINK /ruey.tsay/teaching/fts/m-gs.dat m-gs.dat(9) Weekly Treasury Bill rates: HYPERLINK /ruey.tsay/teaching/fts/w-tb3ms.d

5、at w-tb3ms.dat & HYPERLINK /ruey.tsay/teaching/fts/w-tb6ms.dat w-tb6ms.dat Data setsfor Exercises: 1.Log returns of Alcoa stock: HYPERLINK /ruey.tsay/teaching/fts/d-aa9099.dat d-aa9099.dat Log returns of American Express stock: HYPERLINK faculty.chicag

6、/ruey.tsay/teaching/fts/d-axp9099.dat d-axp9099.dat Log returns of Disney stock: HYPERLINK /ruey.tsay/teaching/fts/d-dis9099.dat d-dis9099.dat Log returns of Chicago Tribune stock: HYPERLINK /ruey.tsay/teaching/fts/d-trb9099.dat d-trb9099.dat

7、 Log returns of Tyco International stock: HYPERLINK /ruey.tsay/teaching/fts/d-tyc9099.dat d-tyc9099.dat2. Monthly log stock returns of five U.S. companies: Alcoa: HYPERLINK /ruey.tsay/teaching/fts/m-aa6299.dat m-aa6299.dat American Express: HYPERLINK f

8、/ruey.tsay/teaching/fts/m-axp7399.dat m-axp7399.datDisney: HYPERLINK /ruey.tsay/teaching/fts/m-dis6299.dat m-dis6299.dat General Motors: HYPERLINK /ruey.tsay/teaching/fts/m-gm6299.dat m-gm6299.dat Hershey Foods: HYPERLINK faculty

9、./ruey.tsay/teaching/fts/m-hsy6299.dat m-hsy6299.dat Mellon Financial Co.: HYPERLINK /ruey.tsay/teaching/fts/m-mel7399.dat m-mel7399.dat3. See Alcoa stock returns in Problem 2.4. See American Express stock returns in Problem 2.5. See American Express stock ret

10、urns in Problem 1.6. Exchange rates of Canadian Dollar, German Mark, United Kingdom Pound,Japanese Yen, and French Francversus U.S. Dollar: HYPERLINK /ruey.tsay/teaching/fts/forex-c.dat forex-c.datChapter 2: Linear Time Series Analysis and Its ApplicationsData sets used in th

11、e chapter:(1) U.S. quarterly growth rates of GNP: HYPERLINK /ruey.tsay/teaching/fts/q-gnp.dat q-gnp.dat(2) Monthly value-weighted index returns: HYPERLINK /ruey.tsay/teaching/fts/m-vw.dat m-vw.dat(3) Monthly equal-weighted index returns: HYPERLINK facu

12、/ruey.tsay/teaching/fts/m-ew.dat m-ew.dat(4) Monthly log returns of 3M stock: HYPERLINK /ruey.tsay/teaching/fts/m-3m4699.dat m-3m4699.dat(5) Quarterly earnings per share of Johnson & Johnson: HYPERLINK /ruey.tsay/teaching/fts/jnj.da

13、t jnj.dat(6) Weekly U.S. Treasury 1-y and 3-y constant maturity rates: HYPERLINK /ruey.tsay/teaching/fts/wgs1yr.dat w-gs1yr.dat and HYPERLINK /ruey.tsay/teaching/fts/wgs3yr.dat w-gs3yr.datData sets for Exercises: 3. Simple returns on monthly U.S. bonds

14、: HYPERLINK /ruey.tsay/teaching/fts/m-bnd.dat m-bnd.dat 4. Daily log returns of Alcoa stock: HYPERLINK /ruey.tsay/teaching/fts/d-aa9099.dat d-aa9099.dat 5. Daily log returns of Hewlett-Packard, value-weighted, equal-weighted and SP500 index: HYPERLINK

15、/ruey.tsay/teaching/fts/d-hwp3dx8099.dat d-hwp3dx8099.dat6. Monthly log returns of equal-weighted index: HYPERLINK /ruey.tsay/teaching/fts/m-ew6299.dat m-ew6299.dat7. See Problem 5.8. Daily log returns of equal-weighted index: see Problem 5. Calendar o

16、f 1980 on (yr,mm,dd,date): HYPERLINK /ruey.tsay/teaching/fts/day80on.dat day80on.dat Dummy variables (M,T,W,R,yr,mm,dd,days): HYPERLINK /ruey.tsay/teaching/fts/wkdays8099.dat wkdays8099.dat9. Log prices of futures and spot of SP500: HYPERLINK faculty.c

17、/ruey.tsay/teaching/fts/sp5may.dat sp5may.dat10. U.S. quarterly unemployment rates: HYPERLINK /ruey.tsay/teaching/fts/qunemrate.dat q-unemrate.dat11. Quarterly GDP implicit price deflator: HYPERLINK /ruey.tsay/teaching/fts/gdpipd.dat gdp

18、ipd.datChapter 3: Conditional Heteroscedastic ModelsData sets used in the text:(1) Monthly simple returns of Intel stock HYPERLINK /ruey.tsay/teaching/fts/m-intc.dat : m-intc.dat RATS program for an ARCH(3) model: HYPERLINK /ruey.tsay/teaching/fts/m-in

19、tc.rats m-intc.rats(2) 10-m log returns of FX (Mark-US): HYPERLINK /ruey.tsay/teaching/fts/exch-perc.dat exch-perc.dat(3) Excess returns of S&P500: HYPERLINK /ruey.tsay/teaching/fts/sp500.dat sp500.dat RATS programs for variousvolatility models: (a) AR

20、(3)-GARCH(1,1): HYPERLINK /ruey.tsay/teaching/fts/m-sp-ar-garch11.rats m-sp-ar-garch11.rats (b) GARCH(1,1): HYPERLINK /ruey.tsay/teaching/fts/m-sp-garch11.rats m-sp-garch11.rats (c) GARCH(1,1) with t_5: HYPERLINK /ruey.tsay/teac

21、hing/fts/t5-garch11.rats t5-garch11.rats (d) GARCH(1,1) with t: HYPERLINK /ruey.tsay/teaching/fts/garch11-t.rats garch11-t.rats (e) IGARCH(1,1): HYPERLINK /ruey.tsay/teaching/fts/m-sp-igarch.rats m-sp-igarch.rats (f) GARCH(1,1)-M model: HYPERLINK facul

22、/ruey.tsay/teaching/fts/m-sp-garchm.rats m-sp-garchm.rats (g) CHARMA model: HYPERLINK /ruey.tsay/teaching/fts/sp-charma.rats sp-charma.rats(4) Monthly log returns of IBM stock: HYPERLINK /ruey.tsay/teaching/fts/m-ibmln.dat m-ibmln.da

23、t RATS program for EGARCH(1,0): HYPERLINK /ruey.tsay/teaching/fts/ibm-egarch10.rats ibm-egarch10.rats (5) Daily log returns of SP500 index: see d-hwp3dx8099.dat in Chapter 2.(6) Monthly log returns of IBM stock& SP500: HYPERLINK /ruey.tsay/teaching/fts

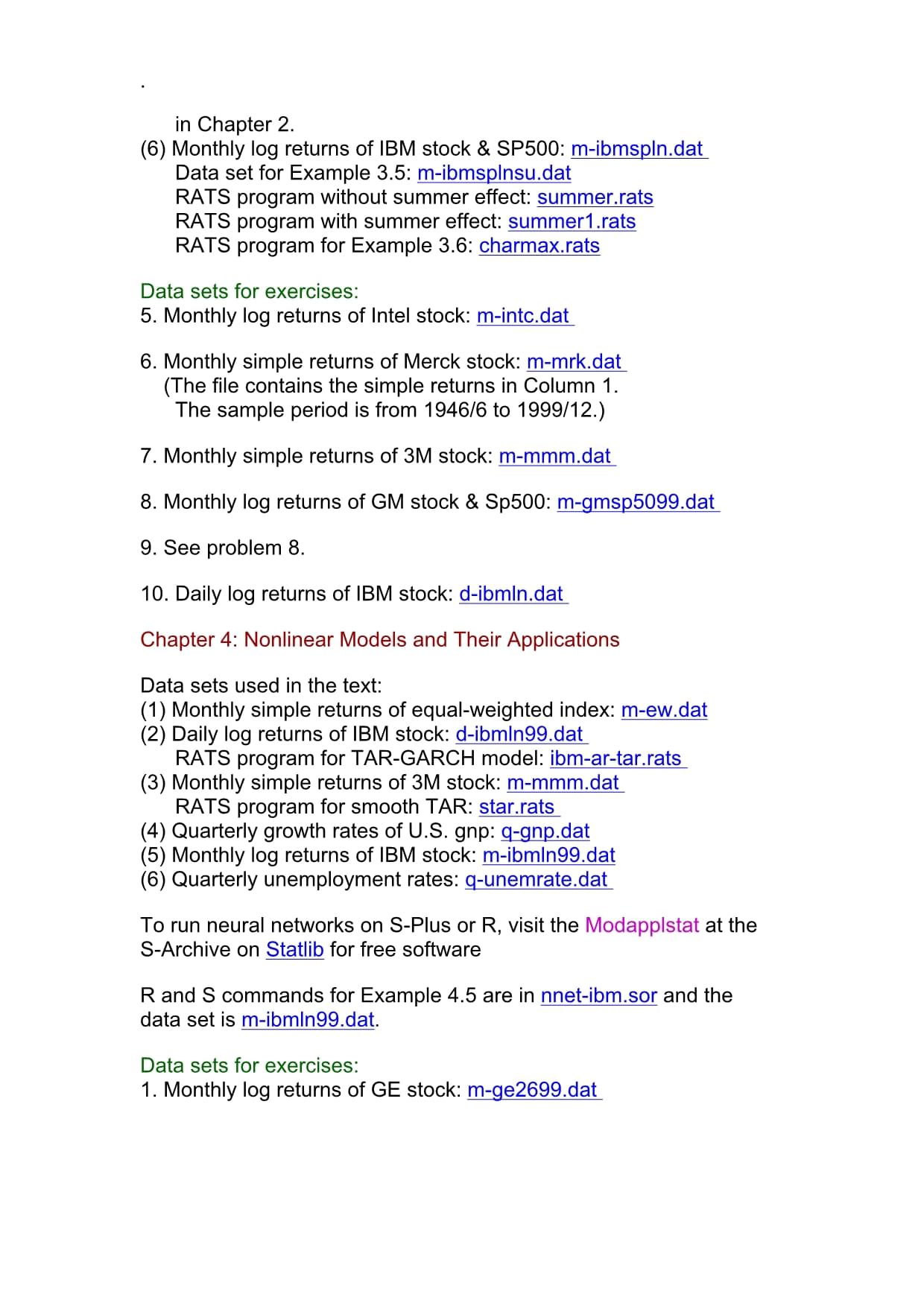

24、/m-ibmspln.dat m-ibmspln.dat Data set for Example 3.5: HYPERLINK /ruey.tsay/teaching/fts/m-ibmsplnsu.dat m-ibmsplnsu.dat RATS program without summer effect: HYPERLINK /ruey.tsay/teaching/fts/summer.rats summer.rats RATS program with summer effect: HYPE

25、RLINK /ruey.tsay/teaching/fts/summer1.rats summer1.rats RATS program for Example 3.6: HYPERLINK /ruey.tsay/teaching/fts/charmax.rats charmax.rats Data setsfor exercises:5. Monthly log returns of Intel stock: HYPERLINK /ruey.tsay

26、/teaching/fts/m-intc.dat m-intc.dat 6. Monthly simple returns of Merck stock: HYPERLINK /ruey.tsay/teaching/fts/m-mrk.dat m-mrk.dat (The file contains the simple returns in Column 1. The sample period is from 1946/6 to 1999/12.)7. Monthly simple returns of 3M stock: HYPERLINK

27、 /ruey.tsay/teaching/fts/m-mmm.dat m-mmm.dat 8. Monthly log returns of GM stock & Sp500: HYPERLINK /ruey.tsay/teaching/fts/m-gmsp5099.dat m-gmsp5099.dat 9. See problem 8.10. Daily log returns of IBM stock: HYPERLINK /ruey.tsay/t

28、eaching/fts/d-ibmln.dat d-ibmln.dat Chapter 4: Nonlinear Models and Their ApplicationsData sets used in the text:(1) Monthly simple returns of equal-weighted index: HYPERLINK /ruey.tsay/teaching/fts/m-ew.dat m-ew.dat(2) Daily log returns of IBM stock: HYPERLINK faculty.chicag

29、/ruey.tsay/teaching/fts/d-ibmln99.dat d-ibmln99.dat RATS program for TAR-GARCH model: HYPERLINK /ruey.tsay/teaching/fts/ibm-ar-tar.rats ibm-ar-tar.rats (3) Monthly simple returns of 3M stock: HYPERLINK /ruey.tsay/teaching/fts/m-mmm.dat m-mmm.

30、dat RATS program for smooth TAR: HYPERLINK /ruey.tsay/teaching/fts/star.rats star.rats (4) Quarterly growth rates of U.S. gnp: HYPERLINK /ruey.tsay/teaching/fts/dgnp82.dat q-gnp.dat (5) Monthly log returns of IBM stock: HYPERLINK faculty.chicagobooth.e

31、du/ruey.tsay/teaching/fts/m-ibmln99.dat m-ibmln99.dat(6) Quarterly unemployment rates: HYPERLINK /ruey.tsay/teaching/fts/qunemrate.dat q-unemrate.dat To run neural networks on S-Plus or R, visit the Modapplstat at the S-Archive on HYPERLINK Statlib for free soft

32、wareR and S commands for Example 4.5 are in HYPERLINK /ruey.tsay/teaching/fts/nnet-ibm.sor nnet-ibm.sor and thedata set is HYPERLINK /ruey.tsay/teaching/fts/m-ibmln99.dat m-ibmln99.dat.Data setsfor exercises: 1. Monthly log returns of GE stock: HYPERLI

33、NK /ruey.tsay/teaching/fts/m-geln-p.dat m-ge2699.dat 5. Weekly U.S. interest rates: (a) Treasury 1-year constant maturity rates: HYPERLINK /ruey.tsay/teaching/fts/wgs1yr.dat wgs1yr.dat (b) Treasury 3-year constant maturity rates: HYPERLINK faculty.chic

34、/ruey.tsay/teaching/fts/wgs3yr.dat wgs3yr.dat Chapter 5: High-Frequency Data Analysis and MarketMicrostructureData stes used in the text: (1) IBM transactions data (11/1/90-1/31/91): The columns are date/time, volume, bid quote, ask quote, and transaction price: HYPERLINK faculty.chicago

35、/ruey.tsay/teaching/fts/ibm.txt ibm.txt (large)(2) IBM transactions data of December 1999. (day. time, price): HYPERLINK /ruey.tsay/teaching/fts/ibm9912-tp.dat ibm9912-tp.dat (large)(3) Adjusted time durations between trades (11/01/90- 1/31/91). Positive durations on

36、ly: HYPERLINK /ruey.tsay/teaching/fts/ibmdurad.dat ibmdurad.dat(4) Adjusted durations in (3) for the first 5 trading days: HYPERLINK /ruey.tsay/teaching/fts/ibm1to5-dur.dat ibm1to5-dur.dat (5) Data for Example 5.2 (files are relatively large) (a) The A

37、DS file: HYPERLINK /ruey.tsay/teaching/fts/ibm91-ads.dat ibm91-ads.dat (b) The explanatory variables as defined: HYPERLINK /ruey.tsay/teaching/fts/ibm91-adsx.dat ibm91-adsx.dat (6) Transactions data of IBM stock on November 21, 1990 (a) original data:

38、HYPERLINK /ruey.tsay/teaching/fts/day15-ori.dat day15-ori.dat (b) data for PCD models: HYPERLINK /ruey.tsay/teaching/fts/day15.dat day15.dat data descriptions in file HYPERLINK /ruey.tsay/teaching/fts/day15.txt day15.txt RATS pr

39、ograms for estimating duration models:The data file used is HYPERLINK /ruey.tsay/teaching/fts/ibm1to5-dur.dat ibm1to5-dur.dat.(a) EACD model: HYPERLINK /ruey.tsay/teaching/fts/eacd.rats eacd.rats(b) WACD model: HYPERLINK /ruey.t

40、say/teaching/fts/wacd.rats wacd.rats(c) GACD model: HYPERLINK /ruey.tsay/teaching/fts/gacd.rats gacd.rats(d) Threshold-WACD model: HYPERLINK /ruey.tsay/teaching/fts/tar-wacd.rats tar-wacd.rats.Data sets for exercises:3. Adjusted durations of IBM stock

41、(11/2/90): HYPERLINK /ruey.tsay/teaching/fts/ibm-d2-dur.dat ibm-d2-dur.dat5. Transactions data of 3M (12/99): HYPERLINK /ruey.tsay/teaching/fts/mmm9912-dtp.dat mmm9912-dtp.dat(large)6. Adjusted durations of 3M (12/99): HYPERLINK faculty.chicagobooth.ed

42、u/ruey.tsay/teaching/fts/mmm9912-adur.dat mmm9912-adur.datChapter 6: Continuous-Time Models and Their ApplicationsData sets used in the text:(1) Daily simple returns of IBM stock in 1998: HYPERLINK /ruey.tsay/teaching/fts/ibmy98.dat ibmy98.dat(2) Daily log returns of Cisco st

43、ock in 1999: HYPERLINK /ruey.tsay/teaching/fts/d-cscoy99ln.dat d-cscoy99ln.datSource codeof a Fortran program for European call and put options based on the simple jump diffusion model discussed in the text: HYPERLINK /ruey.tsay/teaching/fts/kou.f kou.

44、f (You need to compile the program.)Chapter 7: Extreme Values, Quantile Estimation, and Value at RiskData sets used in the text:(1) Daily log returns of IBM stock: HYPERLINK /ruey.tsay/teaching/fts/d-ibmln98.dat d-ibmln98.dat(9190 obs) The returns are in percentages.(2) RATS

45、programs used in Example 7.3: (Note: returns used in the example are not in percentages.) (a) AR(2)-GARCH(1,1): HYPERLINK /ruey.tsay/teaching/fts/example7-3a.rats example7-3a.rats (b) AR(2)-GARCH(1,1)-t5: HYPERLINK /ruey.tsay/teaching/fts/example7-3b.r

46、ats example7-3b.rats (3) Daily log returns of Intel stock (Example 7.4): HYPERLINK /ruey.tsay/teaching/fts/d-intc7297.dat d-intc7297.dat(4) Data used in Subsection 7.7.6 (a) Mean-corrected daily log returns of IBM: HYPERLINK /ruey.tsay/teaching/fts/ibm

47、ln98wm.dat ibmln98wm.dat (b) The explanatory variables on page 294: HYPERLINK /ruey.tsay/teaching/fts/ibml25x.dat ibml25x.dat Data sets for exercises:1. Daily log returns (in percentages) of GE stock: HYPERLINK /ruey.tsay/teaching/fts/d-geln.dat d-geln

48、.dat2. Daily log returns (in percentages) of Cisco stock: HYPERLINK /ruey.tsay/teaching/fts/d-csco9199.dat d-csco9199.dat3. See problem 2.4. Daily log returns of HP and 3 indexes: HYPERLINK /ruey.tsay/teaching/fts/d-hwp3dx8099.dat d-hwp3dx8099.datChapt

49、er 8: Multivariate Time Series Analysis and Its ApplicationsData sets used in the text:(1) Monthly log returns of IBM and SP 500: HYPERLINK /ruey.tsay/teaching/fts/m-ibmspln.dat m-ibmspln.dat The SCA commands used to analyze the series: HYPERLINK /ruey

50、.tsay/teaching/fts/sca-ex-ch8.txt sca-ex-ch8.txt Source code of a Fortran program for multivariate Q-stat: HYPERLINK /ruey.tsay/teaching/fts/qstat.f qstat.f(2) Monthly simple returns of bond indexes: HYPERLINK /ruey.tsay/teaching/fts/m-bnd.dat m-bnd.da

51、t (3) Monthly U.S. interest rates of Example 8.6: HYPERLINK /ruey.tsay/teaching/fts/m-gs1n3.dat m-gs1n3.dat SCA commands used: HYPERLINK /ruey.tsay/teaching/fts/sca-ex8-6.txt sca-ex8-6.txt(4) Log prices of SP500 index futures and shares: HYPERLINK facu

52、/ruey.tsay/teaching/fts/sp5may.dat sp5may.dat(5) Monthly log returns of IBM, HWP, INTC, MER & MWD: HYPERLINK /ruey.tsay/teaching/fts/m-5cln.dat m-5cln.dat Data sets for exercises:1. Monthly log returns of MRK et al.: HYPERLINK /ruey

53、.tsay/teaching/fts/m-mrk2vw.dat m-mrk2vw.dat2. Monthly U.S. interest rates (1 & 10 yrs): HYPERLINK /ruey.tsay/teaching/fts/m-gs1n10.dat m-gs1n10.dat3. See problem 2.4. See problem 2.Chapter 9: Multivariate Volatility Models and Their ApplicationsData sets used in the text: (1

54、) Daily log returns of HK and Japan market index (Example 9.1): Data file (491 data pts): HYPERLINK /ruey.tsay/teaching/fts/hkja.dat hkja.dat Bivariate GARCH programs: HYPERLINK /ruey.tsay/teaching/fts/hkja-c.rats hkja-c.ratsand HYPERLINK faculty.chica

55、/ruey.tsay/teaching/fts/hkja-c1.rats hkja-c1.rats(2) Monthly log returns of IBM and SP 500: HYPERLINK /ruey.tsay/teaching/fts/m-ibmspln.dat m-ibmspln.dat Constant-correlation GARCH program: HYPERLINK /ruey.tsay/teaching/fts/ibmsp-ex92.rats ibmsp-ex92.rats Time-varying correlation GARCH: HYPERLINK faculty.

温馨提示

- 1. 本站所有资源如无特殊说明,都需要本地电脑安装OFFICE2007和PDF阅读器。图纸软件为CAD,CAXA,PROE,UG,SolidWorks等.压缩文件请下载最新的WinRAR软件解压。

- 2. 本站的文档不包含任何第三方提供的附件图纸等,如果需要附件,请联系上传者。文件的所有权益归上传用户所有。

- 3. 本站RAR压缩包中若带图纸,网页内容里面会有图纸预览,若没有图纸预览就没有图纸。

- 4. 未经权益所有人同意不得将文件中的内容挪作商业或盈利用途。

- 5. 人人文库网仅提供信息存储空间,仅对用户上传内容的表现方式做保护处理,对用户上传分享的文档内容本身不做任何修改或编辑,并不能对任何下载内容负责。

- 6. 下载文件中如有侵权或不适当内容,请与我们联系,我们立即纠正。

- 7. 本站不保证下载资源的准确性、安全性和完整性, 同时也不承担用户因使用这些下载资源对自己和他人造成任何形式的伤害或损失。

最新文档

- 一的变调练习题

- 二零二五年度重型吊车安全责任及运输合同3篇

- 压疮的预防及护理课件

- 射箭游戏-数学

- 2024年浙江宇翔职业技术学院高职单招职业适应性测试历年参考题库含答案解析

- 2024年济源职业技术学院高职单招职业适应性测试历年参考题库含答案解析

- 《科幻小说赏析与写作》 课件 -第三章 “太空歌剧”的探索与开拓-《2001太空漫游》

- 2024年河南工业贸易职业学院高职单招职业技能测验历年参考题库(频考版)含答案解析

- 二零二五年租赁权转让及配套设备协议范本3篇

- 2024年沧州职业技术学院高职单招语文历年参考题库含答案解析

- 2025年中国AI AGENT(人工智能体)行业市场动态分析、发展方向及投资前景分析报告

- 家居建材行业绿色材料应用及节能设计方

- 农副产品安全培训

- 2024年中国玩具工程车市场调查研究报告

- 2025-2030年中国电动三轮车市场发展现状及前景趋势分析报告

- TCABEE 063-2024 建筑光储直柔系统变换器 通 用技术要求

- 【9化期末】合肥市庐阳区2023-2024学年九年级上学期期末化学试题

- 高一下学期生物人教版必修二:3.4 基因通常是有遗传效应的DNA片段课件

- 下属企业考核报告范文

- 修车补胎合同范例

- 2024年基金应知应会考试试题

评论

0/150

提交评论